My mom told me this story that I won’t soon forget. After a lady had passed away her kids were going through her house and belongings and to their surprise, they discovered that their mom had stashed cash everywhere. She hid it in books, behind picture frames, in cupboards, behind curtains, under mattresses, basically anywhere the visible eye couldn’t plainly see. I’m sure it was a fun treasure hunt in light of the circumstances, but the more I thought about it the more I wondered how much cash they ended up with. I was even more curious as to if the lady ever knew how much she had stashed around the house or if she even remembered where it all was.

This was fun for her kids, but wouldn’t it be frustrating if our relationship with money was actually like that? It’s the worst feeling when you are expecting your savings to grow, but it is progressing at the pace of Flash the sloth. This can be the result of not knowing where your money goes, not knowing how much you actually have, or not being able to find it. Which is all SO frustrating, but that’s why I developed this method of tracking my money that works for me. And I made it easy. Easy to the point where I don’t think it could be any easier.

I always thought that the people who were good at money spent hours pouring over bills, receipts, and budgets and I knew I didn’t have time for that so I always worried that I was somehow going to lose all of it.

Luckily, that really is NOT the case. The unexpected “hack” I learned is that those who are good with their money watch their money. Just like somebody who likes to people watch essentially they like to money watch. And using this method of how I track my money will help you become a “money watcher” so you are aware of what’s happening in your bank account.

So what is the easy way I track my money?

THE EASY WAY I TRACK MY MONEY IS BY GOING THROUGH EVERY TRANSACTION.

Now you might be thinking “are you kidding me that sounds like a lot of work” or “I don’t have time to figure all of that out”, but in reality, it is so so so easy and requires minimal effort.

Here is what I do:

I first grab my laptop and log in to my online banking account. All my money comes and goes through my checking account so I pull up my checking account statement for the month.

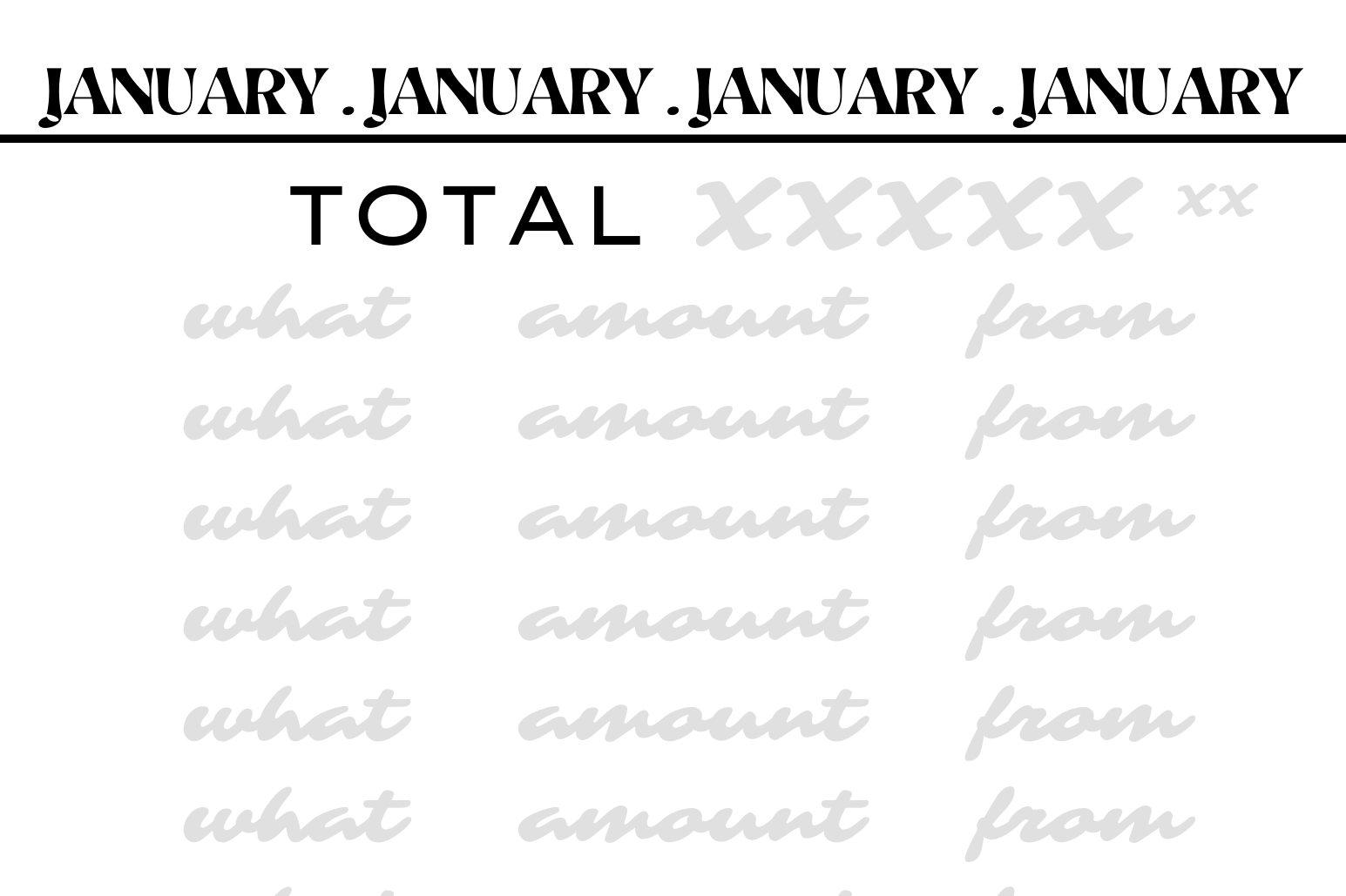

Second, I pull out a printable that I made which I use as an expense sheet. You can just grab a blank piece of paper and make 3 columns labeled WHAT AMOUNT and FROM or you can check out this exact printable which provides a sheet for every month. This is what mine looks like.

As we are filling out this expense sheet we are focused on three things

1. Purchases

2. Cash

3. Refunds

purchases

Your purchases are simple because you are basically copying everything from your bank statement to the expense sheet. Needless of an explanation, start at the beginning and work your way through to the end of the month.

My first transaction of every month is always my Spotify subscription. It is the first thing on my bank statement so it usually ends up being the first thing on my expense sheet. When writing it down, on “what” I write SPOTIFY on “amount” I write -9.99, and on “from” I write CHECKING.

what = spotify amount = -9.99 from = checking

cash

I originally started this method of tracking my money because though every swipe of my card was kept on record, my cash wasn’t. That’s the beauty of a checking account because it remembers everything for you. However, I still use cash sometimes so at the end of the month when I review my bank statement, it’s not really the total amount of money I spent because the cash isn’t added in. Therefore, I keep every receipt during the month so I can write them down and add them to my total expenses. This is how I would write a cash transaction:

what = groceries amount = -46.52 from = cash

refunds

With the countless amount of stores you can order from online now, I have found myself shopping more online rather than in-store. I love it because though a store may run out of my size, online doesn’t; they also often have online exclusives and actually ordering something may be the only way to have it as some stores are solely online. That being said, it is my responsibility to make sure I get my money back if I make a return because who wants to pay for something that doesn’t work out? Not me! Furthermore, adding back in your refunds is important to have an accurate total amount. Say I spent $100 on Amazon, but I ended up returning something that was $30. I didn’t actually spend $100 I only spent $70. Refunds will either be on your bank statement if you paid online or a receipt if you paid cash in-store. This is what a refund transaction looks like:

what = shoes amount = +32.36 from = Amazon

Another important thing to note is that with my amounts I always label them as “+” or “-” so I know I spent money or I got money back.

In the end, after writing down every purchase, cash, or refund transaction I total the amounts and write the sum at the top.

And that’s it! It’s that easy!

This is my all-time favorite way I track my money because I can look back and see exactly where my money is going and how much. It is also eye-opening because more than once I have thought “what the heck is all this stuff I’m buying on amazon?” and then as I do a deeper dive I can distinguish and say “yes that was a necessary purchase” or “hey, next month I am going to try to limit my amazon orders”. I have also caught a subscription I unsubscribed from that still took a monthly payment and I have found returns that weren’t coming through.

It’s all about being aware of your money and when using this method you can see where every cent goes.

If you want you can take your income from the month and subtract the total of the expenses you just found to see what is left over. If you don’t like the number, download my freebie which is “20 Tips to Save Money”.

To wrap this up let me give you one more reason I love this method. This is the perfect foundation to build upon. If you want to be strategic with your money such as saving “x” amount or creating a budget this is the place to start. The possibilities are endless so subscribe to my newsletter so you don’t miss my future post which will be going more in-depth on this!

Happy Money Tracking!!

xxxKarlie